Investment Summary

Mispricing & Turnaround Narrative: JD.com is materially mispriced at ~$42 per share (around 16× forward earnings) given its ongoing turnaround under founder Richard Liu. Investor pessimism from China’s economic slowdown and intense competition has left JD trading at a deep discount, pricing in low growth and subpar margins. However, JD is executing a strategic reset – cutting costs, refocusing on high-margin growth, and leveraging its logistics and technology advantages – that is driving an inflection in earnings. In Q4 2024, JD’s net income surged nearly +190% year-on-year on a +13% revenue increase, showcasing dramatically improved operational efficiency and a business at a turning point. The market is overlooking JD’s earnings rebound and margin gains, creating an asymmetric risk-reward opportunity: we see roughly 40% upside as fundamentals and sentiment recover, versus ~15% downside cushioned by JD’s strong cash flows (9–10% free cash flow yield) and net cash-rich balance sheet. In short, JD’s turnaround is gaining traction, making this a high-conviction buy.

Risk-Reward Setup: At current levels, JD offers deep value with significant growth optionality. Multiple catalysts (detailed below) could drive a re-rating of JD’s modest ~16× P/E toward ~20×, unlocking a share price of ~$60 within 12 months. Meanwhile, downside appears limited to the mid-$30s (roughly -15%) even in a harsher scenario, given JD’s tangible book value, persistent free cash flow generation, and ongoing share buybacks. This favorable risk-reward profile – backed by a low beta around 0.75 (lower volatility than the market) and a robust balance sheet – underpins our conviction. We believe the current valuation implies overly pessimistic assumptions that underestimate JD’s true earnings power post-turnaround.

Company Overview – Strategic Reset Under Richard Liu

China’s #2 E-commerce Platform, Refocusing on Efficiency: JD.com is one of China’s e-commerce leaders (~16% market share), known for its direct-sales model and unrivaled logistics network. Unlike Alibaba’s marketplace approach, JD sells products directly and fulfills orders through its own infrastructure – over 1,600 warehouses and a delivery fleet of 500,000+ staff enabling 90% of orders to reach customers same- or next-day. This vertically integrated model built JD’s reputation for authentic products and fast delivery in a market often plagued by counterfeits and slow shipping. After years of aggressive expansion (25% revenue CAGR from 2014–2020), JD’s growth slowed to ~5% in 2023 amid economic headwinds. In response, founder Richard Liu reasserted strategic control in late 2022, pivoting the company from pure expansion toward profitability and disciplined growth.

Key Strategic Changes Under Liu: JD has implemented a “strategic reset” with three focal areas to revive earnings growth and improve efficiency:

AI-Driven Logistics: JD ramped investments (about $1 billion annually) in AI and automation to optimize its supply chain and warehousing. These investments have sped up delivery times by ~15% and significantly improved logistics productivity. Notably, JD’s logistics segment margin swung from -2% in 2022 to roughly +5% by late 2024. Automated warehouses, smart r

oute planning, and delivery drones are reducing fulfillment costs and boosting operating leverage in the core retail business.

Capital Discipline: JD is streamlining operations and costs, instilling a more frugal culture from the top down, and returning cash to shareholders. Management undertook senior pay cuts, narrowed loss-making initiatives, and refocused on core profitable segments. In 2024, the company repurchased ~8% of its outstanding shares (fully utilizing a $3 billion buyback authorization) and has authorized a new $5 billion repurchase program. It also raised its annual dividend by 20% (declaring $1.00 per ADS for 2024). These moves signal a strong commitment to shareholder value and more prudent capital allocation, a clear shift from JD’s prior growth-at-all-costs approach.

Category Expansion: JD is pushing into higher-margin, high-growth product categories such as healthcare, groceries, and luxury goods. For example, JD Health, its online healthcare arm (pharmacy and telemedicine), is growing over +20% year-on-year with an ~8% operating margin (above JD’s core retail margin) – we estimate JD Health is on track to exceed $3 billion in annual revenue by 2025, contributing a steady, high-margin income stream. Similarly, JD has partnered with top luxury brands (LVMH, Richemont, etc.) to develop a burgeoning online luxury goods segment, which saw double-digit growth (+15% YoY) in recent quarters. Management projects luxury gross merchandise value (GMV) could reach ~$5 billion by 2027, adding a lucrative revenue source and further strengthening JD’s image as a premium, quality-focused platform beyond its traditional electronics and home appliance stronghold.

This strategic pivot – combining JD’s traditional strengths (trusted direct retail and nationwide logistics) with newfound cost discipline and new revenue streams – has laid the groundwork for reaccelerating earnings growth with a healthier margin profile. JD is essentially evolving from a breakneck expansion phase to a more mature, efficiency-driven phase, which forms the basis of our investment thesis.

Industry Overview – E-commerce Recovery & JD’s Competitive Moat

China E-commerce Rebounding: After a period of tepid consumer spending, China’s e-commerce sector is poised for a rebound. The government is rolling out significant stimulus measures in 2025 to spur consumption (a rumored fiscal package of ¥8–9 trillion, or ~$1.2 trillion, targeting consumers and infrastructure). In 2023, online retail sales in China already grew ~8.8%, and this could accelerate further as the economy stabilizes and consumer confidence returns. This macro tailwind directly benefits JD, which generates the vast majority of its revenue domestically and has broad exposure to rising consumer demand (including roughly 40% of sales from less-penetrated rural regions). With its strong logistics presence even in rural areas, JD is well-positioned to capitalize on a new wave of online shoppers and increased spending power outside tier-1 cities as stimulus measures take effect.

Competitive Landscape: China’s online retail market is dominated by three players with distinct models: Alibaba (Taobao/Tmall, ~45% market share) operates an asset-light marketplace linking buyers and third-party sellers, which yields high margins but has faced issues with counterfeit goods and saturating growth. Pinduoduo (PDD) (~13% share) pioneered social commerce with a focus on bargain pricing in lower-tier cities; its lean platform (minimal self-owned logistics) delivers extraordinary profit margins (~30%+) but often at the expense of customer service and product quality. JD.com (~16% share) runs a direct retail model with its own inventory and end-to-end logistics. JD’s approach sacrifices some margin for superior control over product authenticity and fulfillment speed. This trade-off has built JD a loyal customer base, especially in higher-tier cities and quality-sensitive categories.

JD’s Moat – Logistics & Trust: JD’s vertically integrated logistics network provides a durable competitive moat that its peers struggle to match. The company’s army of couriers and network of warehouses enable 90%+ same-day or next-day delivery nationwide – a service level neither Alibaba (which relies on third-party delivery firms) nor Pinduoduo can replicate. Fast, reliable delivery and assured product authenticity drive higher customer satisfaction and trust in JD’s platform. This is especially crucial for products like electronics and luxury items, where consumers demand authenticity and timely service over rock-bottom prices. As Chinese consumers become more discerning and service-oriented, JD’s brand equity in quality and reliability positions it to capture outsized share of the e-commerce recovery. Importantly, JD’s current operating margin (~3–4% in 2024) significantly trails Alibaba’s (~15%) and Pinduoduo’s (~30%+). This gap is not due to a flawed model but rather JD’s deliberate heavy investment in logistics and customer service over the years. Now, with those investments maturing and a strategic refocus on efficiency, JD has a clear runway to improve margins, closing some of that gap while maintaining its service advantage. The ability to narrow the margin gap without sacrificing its moat is a key component of the upside case for JD.

Source: FiveNine Focus

Investment Thesis – Catalysts for Value Realization

Several catalysts are underway that should drive improved financial performance for JD.com and help close the valuation gap. We outline the key thesis points and their anticipated impact:

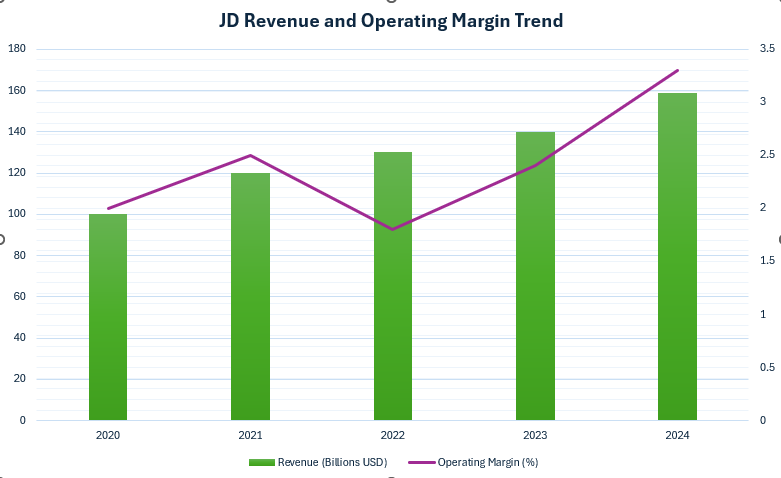

1. Logistics Optimization Driving Margin Expansion: Years of heavy investment in automation and AI are now bearing fruit in the form of higher efficiency and expanding margins. JD’s ~$1 billion+ annual spend on smart logistics has increased throughput and reduced delivery costs per order. As a result, profitability is inflecting: JD’s income from operations jumped to RMB8.5 billion in Q4 2024 (vs. only RMB2.0 billion in Q4 2023), and the full-year 2024 operating margin rose to 3.3% (from 2.4% in 2023). We expect continued efficiency gains to drive further margin expansion over the next two years. As automated warehouses, AI-driven inventory management, and route optimization scale across JD’s network, the company should see at least +200 basis points of operating margin improvement by 2025–2026 (toward a 5–6% operating margin, up from ~3% now). This alone would lift earnings per share by roughly +20% (for example, from about $2.50 to ~$3.00 in annual EPS, all else equal). Critically, these improvements are coming not from speculative new businesses but from JD’s core operations, indicating a durable step-up in the company’s earning power. Even after this anticipated uplift, JD’s margins would remain well below Alibaba’s, leaving room for further upside beyond 2026. The market is starting to recognize JD’s operating leverage potential, and continued margin wins each quarter will build confidence in the turnaround.

2. Capital Discipline & Shareholder Returns: Management’s more disciplined approach to capital allocation is boosting EPS and could catalyze a valuation re-rating. In 2024, JD aggressively bought back shares and initiated a dividend, signaling that excess cash will be returned to shareholders. This has a twofold effect: it directly increases EPS (via a smaller share count) and it improves investor sentiment toward the stock. JD retired about 8% of its shares in the past year, and going forward the company’s new repurchase authorization (up to $5 billion over 3 years) could reduce the float by ~2–3% annually. This consistent buyback activity, funded by JD’s ample free cash flow (over $6 billion in 2024, roughly a 10% yield on the current market cap), should provide a 3–5% annual tailwind to EPS growth. Meanwhile, the newly raised dividend (equating to ~$1.00 per ADS, or roughly a 2.4% yield at current prices) underscores confidence in JD’s cash generation. A shareholder-friendly JD with prudent cost control and capital returns marks a regime change from its earlier high-growth era. We believe this will attract a broader investor base (including value and income-oriented investors) and support a higher valuation multiple. In effect, JD is transforming into a more mature, cash-generative business – and the market often rewards such a shift with a richer earnings multiple than that of a capital-hungry growth company.

3. New Growth Engines – Healthcare and Luxury Segments: JD’s expansion into new product categories is opening additional avenues of growth and profit that the market isn’t fully pricing in. JD Health, the company’s online healthcare subsidiary, is growing at 20%+ year-over-year as Chinese consumers increasingly purchase medicines, health services, and wellness products online. In Q3 2024, JD Health generated $2.1 billion in revenue (approximately RMB15 billion) with operating margins in the high single digits, outperforming JD’s core retail margin. This business could reach scale in the coming years – management sees JD Health surpassing ~$3 billion in annual revenue by 2025 – and because of its asset-light, service-oriented model, it should sustain higher margins, contributing disproportionately to JD’s bottom line. Likewise, JD’s foray into online luxury retail is gaining momentum. By partnering with premium global brands and guaranteeing authentic products, JD has rapidly grown its luxury goods GMV (approximately +15% YoY in Q3 2024) even as the overall luxury market has been subdued. Management envisions the luxury segment reaching ~$5 billion in GMV by 2027. Luxury retail carries higher gross margins and ticket sizes, so this growth can lift JD’s revenue mix and profitability. Beyond the numbers, success in categories like health and luxury enhances JD’s brand equity as a trusted, high-quality platform, which can have positive spillover effects on its core business (attracting higher-spending customers, increasing customer stickiness, etc.). These new engines provide incremental growth on top of JD’s core e-commerce, and we believe they are underappreciated by investors who still view JD mostly as a low-margin electronics retailer.

4. Macro Tailwinds & Rural Expansion: A recovering consumer environment in China coupled with JD’s strength in underpenetrated regions could drive an upside surprise in top-line growth. As noted, China is implementing major pro-consumption policies in 2025 to rekindle spending. JD, with deep reach into lower-tier cities and rural areas, stands to benefit as disposable incomes rise outside the big metros. Already, JD has seen encouraging signs: its sales in rural areas grew ~10% YoY in Q3 2024 despite the broader economic softness. If the anticipated stimulus boosts consumer confidence, we expect China’s e-commerce growth to accelerate into the high-single digits or even low-double digits in 2025. JD’s management has indicated a baseline expectation of ~7–10% revenue growth for 2025, with potential upside if stimulus-driven demand really kicks in. Because JD has spent years building out logistics in rural provinces and smaller cities (where rivals are less present), it is extremely well-positioned to capture incremental demand from the next cohort of online shoppers. In short, any macro uptick will likely have a magnified effect on JD’s growth. This external tailwind, combined with JD’s internal initiatives, could result in revenue and earnings exceeding current consensus forecasts. We see the macro recovery as a free call option in the JD thesis – it’s not the crux of our case (which is more about margin transformation), but it provides upside that could accelerate investor sentiment change.

Valuation & Expected Re-Rating

Undervalued vs. History and Peers: Despite the improving outlook, JD.com’s current valuation remains undemanding. At ~$42, the stock trades around 16× forward 2025 EPS (using an updated consensus of roughly $2.60 per ADR in earnings) – in line with its 5-year average (~15×) but at the low end of its historical range. For context, JD traded above 20× earnings during its high-growth years, and global e-commerce peers trade at higher multiples. Even domestic peers with their own issues are not much cheaper: Alibaba currently trades around 12× forward earnings and Pinduoduo around 13×. On an enterprise-value basis, JD is valued at roughly 9× EV/EBITDA, which is in line with or slightly below the peer median and at a discount to JD’s own historical ~10× EV/EBITDA. The stock’s price-to-sales ratio is a mere 0.4× (based on ~$159 billion in 2024 revenue), reflecting a market expectation of very thin margins and limited growth ahead. We believe these low multiples severely understate JD’s true earnings power now that the company is prioritizing efficiency. Remember that JD has over $30 billion in cash and investments on its balance sheet (about half the market cap), and it generates substantial free cash flow – factors that provide a cushion and are not fully reflected in a simple P/E multiple. Adjusting for its cash hoard, JD’s ex-cash valuation is even more attractive.

Case for a Re-Rating to ~18–20× P/E: As JD’s margin improvements and growth catalysts materialize over the next year or two, the market should reward the company with a higher earnings multiple more commensurate with its improved fundamentals. We anticipate that with a steady string of better earnings reports, investor perception will shift, and JD could reasonably trade at 18–20× forward earnings. This would still be below major global e-commerce players (which often trade well above 20×) and below JD’s own peak valuations, but it would represent a normalization of sentiment from the current depressed level. Several factors justify a higher multiple for JD: (1) Earnings Growth: JD’s earnings-per-share is on track to grow 15–20% annually over the next few years given the margin expansion and revenue drivers discussed – a growth rate that warrants a growth stock multiple rather than a stagnant one. (2) Reduced Perceived China Risk: If China’s regulatory and macro overhangs continue to ease (as we expect with clearer government policies and stimulus support), investors will demand a smaller risk discount for Chinese tech stocks. JD, being a domestically focused business aligned with policy priorities (job creation, domestic consumption), could see a particularly strong sentiment rebound. (3) Business Quality and Moat: JD’s fundamentals now more closely resemble a high-quality retailer with a strong moat and consistent cash flows (akin to an “Amazon of China” in direct retail). Its reliable logistics network and customer loyalty give it a defensible franchise. As the company proves it can generate solid profits, it deserves a premium to the deep-value multiples of the past couple of years. In short, JD is evolving into a more mature, profitable, and shareholder-friendly business, and its valuation should evolve higher to reflect that reality.

Upside/Downside Analysis: Our base case is that JD’s execution continues and market sentiment improves such that by late 2025 the stock commands approximately a 20× P/E on forward earnings. Assuming JD delivers around $3.00 in forward EPS, a 20× multiple would equate to a share price of about $60 per ADR. This represents roughly +40% upside from the current price. We consider this a one-year price target (for the next 12 months) as the market often prices in forward earnings a year out. In a more optimistic scenario – say China’s stimulus sparks stronger consumer spending and JD’s margins expand faster – 2025 EPS could come in closer to $3.20–3.30, and investors might be willing to assign a higher multiple, perhaps 20× or even a bit more. In that bull case, upside could exceed +50% (implying a stock price in the mid-$60s or higher). On the downside, if JD’s turnaround stalls or macro conditions remain weak, the stock might only merit a muted multiple in the low-teens. Even applying a trough valuation of ~12× forward earnings (similar to Alibaba’s current pessimistic valuation) on, say, $2.60 of EPS would yield a stock price around $31. However, such a bearish outcome appears less likely given JD’s substantial net cash position, ongoing buybacks, and high free cash flow, which together provide a valuation floor. A more realistic cautious scenario might be that JD languishes at around a 14× P/E if progress is slower – roughly $35–36 per share, which is near tangible book value and would be about 10–15% below today’s price. Historically, JD’s P/E has ranged from ~12× at extreme pessimism to 20×+ at optimistic peaks. Given the evidence of a turnaround, we expect a move toward the upper-middle of that range. Importantly, the upside potential (~40% or more) outweighs the downside risk (~15% or less) by a comfortable margin, and the current valuation already bakes in a lot of caution, providing a margin of safety. (As a cross-check, a DCF analysis using conservative assumptions – e.g. ~8% WACC, high-single-digit revenue growth for the next decade, and modest long-term margin expansion – yields an intrinsic value in the mid-$50s per share. This supports our view that JD is undervalued and that our $60 target is attainable as execution continues.)

Key Risks & Mitigants

While we are bullish on JD, investors should monitor several risks. We believe these risks are manageable and largely reflected in the stock’s discounted valuation, but we outline them here along with mitigating factors:

Regulatory Risk: China’s regulatory environment for tech companies remains a wildcard. Potential new rules on data privacy, antitrust, or e-commerce practices (for instance, limits on platform fees or heavy-handed price controls) could put pressure on JD’s profitability. For example, if authorities capped online marketplace commission fees at a low rate, JD’s take-rate and margins might be constrained. Mitigant: JD’s direct sales model is less exposed to certain regulations (like marketplace fee caps) compared to peers, since a large portion of its revenue comes from direct product sales rather than commission fees. Moreover, JD has a strong compliance track record and aligns its strategy with Beijing’s priorities (its focus on real-economy logistics infrastructure and job creation dovetails with government objectives). This should make it less likely to be a target of punitive regulation. In summary, while regulatory headlines can cause volatility, JD’s business model and goodwill with policymakers offer some insulation.

Economic/Macro Slowdown: If China’s economic recovery falters or the anticipated stimulus under-delivers, consumer spending could remain soft. In a bear-case scenario of, say, only ~3–5% e-commerce growth in 2025 (versus the 7–10% we currently expect), JD’s revenue would likely disappoint, and operating leverage would be harder to achieve. Mitigant: JD’s value proposition (a wide selection of essential goods, competitive prices, and fast delivery) makes it relatively resilient even in a weak consumption environment. Consumers may cut back on luxury spending, but JD’s core categories include staples like appliances, groceries, and healthcare, which people continue to need. Additionally, JD has shown it can capture market share during lean times by leaning on its efficiencies – for instance, offering discounts via its own “10 Billion Subsidy” program to compete with Pinduoduo, without undercutting its margins severely. In a sluggish economy, JD can pivot to emphasize its cost leadership and service, keeping sales ticking over until macro conditions improve.

Competitive Pressure: Competition in China’s e-commerce remains intense. Pinduoduo’s aggressive growth and deep discounting in lower-tier cities could force JD to cut prices or risk losing customers at the low end. Meanwhile, Alibaba is reorganizing and could reinvigorate its platforms or spin off assets (like its Cainiao logistics arm) to become more competitive. A renewed price war – such as heavy couponing or subsidized shipping – would risk eroding profit margins across the industry. Mitigant: JD has a differentiated market position that insulates it from pure price competition to an extent. It has a loyal customer base in higher-tier cities and among shoppers who prioritize product quality and delivery reliability. These customers are less likely to defect to a purely price-driven platform. JD can also leverage its logistics advantage: even if competitors slash prices, they cannot easily replicate JD’s fast, dependable delivery and after-sales service, especially for higher-value items. We have seen JD maintain roughly its ~16–18% market share in recent quarters by deploying tactical promotions while not fundamentally compromising its margins. In short, JD doesn’t need to win a race to the bottom on price; it competes on service and trust, which is a more defensible arena.

Geopolitical & FX Risk: U.S.-China tensions and geopolitical events pose a risk to Chinese stocks broadly. Trade restrictions, tariffs, or new U.S. laws targeting Chinese companies could indirectly impact JD’s operations or at least hit investor sentiment. Additionally, a weakening of the Chinese yuan (RMB) versus the U.S. dollar would reduce the dollar value of JD’s earnings and could concern dollar-based investors. (Notably, in 2024 the RMB depreciated around 5–6%, which modestly lowered JD’s reported USD revenue and earnings). Mitigant: JD’s business is overwhelmingly domestic – it sources over 90% of products from within China – so direct exposure to tariffs or export controls is minimal. The company also maintains substantial inventory and supply chain buffers (holding over $10 billion in inventory) to navigate any temporary import/export disruptions. The primary effect of geopolitical risk on JD is through sentiment and currency translation. Here, JD’s large cash reserves (partly held in USD) and consistent profitability provide stability. Moreover, the Chinese government’s recent more business-friendly stance has somewhat calmed fears of draconian tech crackdowns, reducing the risk of adverse policy surprises. While U.S.-China relations will likely ebb and flow, JD’s fundamental performance is tied to China’s domestic consumption, which remains a policy focus for Chinese authorities to nurture.

Execution Risks: JD’s ambitious strategic initiatives may not all pan out as expected. The company is betting on AI to streamline logistics, but if these optimizations underdeliver, cost improvements could fall short. Similarly, new ventures like JD Health, international expansion, or partnerships in luxury retail might grow more slowly or face setbacks, which would temper the incremental revenue and profit we are forecasting. There is also the integration risk of managing a sprawling ecosystem (retail, logistics, healthcare, fintech, etc.) efficiently. Mitigant: JD has a solid execution track record in its core business and has consistently met or beaten earnings expectations in recent quarters. The direct involvement of founder Richard Liu (who returned to a hands-on role) adds confidence that the company will course-correct quickly if an initiative isn’t working. We’ve already seen evidence that JD can execute on its efficiency plans – for example, JD Logistics revenue grew 10% YoY in Q4 2024 and turned a profit, while overall operating expenses grew much slower than revenues, indicating disciplined execution of cost cuts. Management has shown a willingness to pull back on underperforming projects (for instance, scaling down the Jingxi hard-discount initiative) to protect margins. This pragmatism in operations reduces the risk of prolonged losses from any single venture. In summary, while execution missteps are a risk for any turnaround, JD’s recent operational performance and strong leadership alignment mitigate this risk.

Overall, JD’s risk factors appear to be well balanced by its strengths and are largely acknowledged in its current cheap valuation. The company’s strong financial position (over $33 billion in cash and short-term investments, and minimal debt for a debt-to-equity ratio of only ~0.3×) and its diversified business lines give it resilience to withstand challenges. We also take comfort in the fact that management and insiders (including Richard Liu) have significant ownership stakes, aligning their interests with shareholders in navigating these risks.

Conclusion & Recommendation

JD.com represents a compelling turnaround play in China’s internet sector – a fundamentally strong business with temporary headwinds that are beginning to abate. The stock’s current valuation offers a significant margin of safety, while multiple upcoming catalysts (internal efficiency gains, new revenue streams, and a supportive macro backdrop) create a clear path for value realization. We expect JD’s steady earnings growth and improving narrative to drive a re-rating toward ~20× earnings, which would unlock roughly a 40% appreciation in the share price to about $60 within the next year. Downside looks limited by JD’s hard assets and cash flow generation, and we would look to manage risk by using a stop-loss near ~$34 (around 13× forward earnings and close to book value) to protect capital if the thesis unexpectedly deteriorates.

Action: Buy JD.com at ~$42. We set a one-year price target of $60, reflecting our base-case fundamental valuation. Given the attractive risk/reward setup and our high conviction in JD’s turnaround, we recommend a 7–10% portfolio position in JD. The company’s moderate risk profile (low beta, strong balance sheet, and consistent cash flow) supports taking an outsized position, while identified mitigants for key risks further bolster confidence. In summary, JD.com’s unique logistics moat, improving margins, and renewed strategic focus make it a top conviction investment to capitalize on China’s e-commerce recovery. The reward far outweighs the risks, and we see significant upside for investors as the market corrects its overly pessimistic view of JD’s prospects.

nice research keep it up